At the height of the 2008 panic, when all seemed lost, out peered a wise man by the name of Warren Buffett:

“So … I’ve been buying American stocks. This is my personal account I’m talking about, in which I previously owned nothing but United States government bonds…If prices keep looking attractive, my non-Berkshire net worth will soon be 100 percent in United States equities.” Buy American. I Am

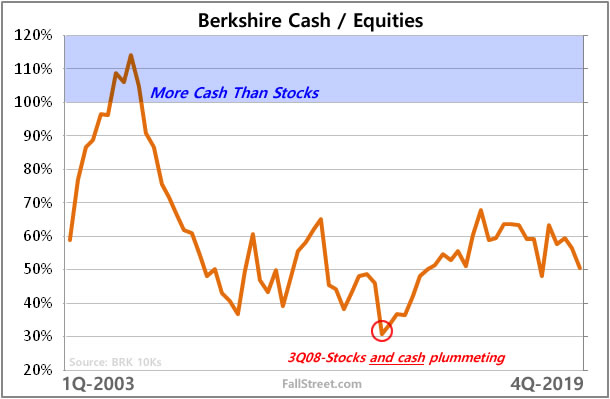

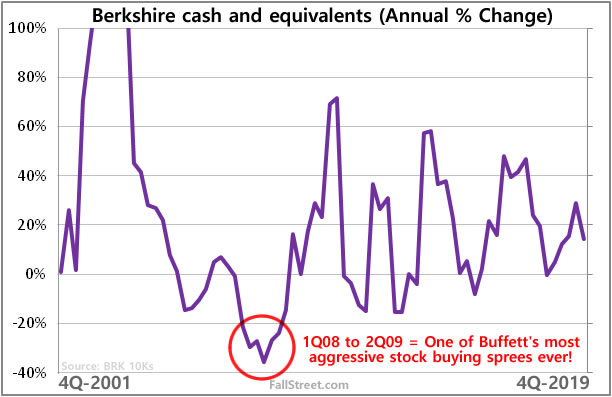

Despite being long-term orientated, Buffett was able to time the March 2009 “bottom” in the markets almost perfectly. The genius of Buffett is readily seen in the following graphs, which shows Berkshire shoveling money into stocks when everyone else was running for the exits. Along with selecting great companies, knowing when to put more/less cash to work is why Buffett outperforms during bear markets. After all, you can only take advantage of a sustained decline in market prices if you have the cash to keep buying!

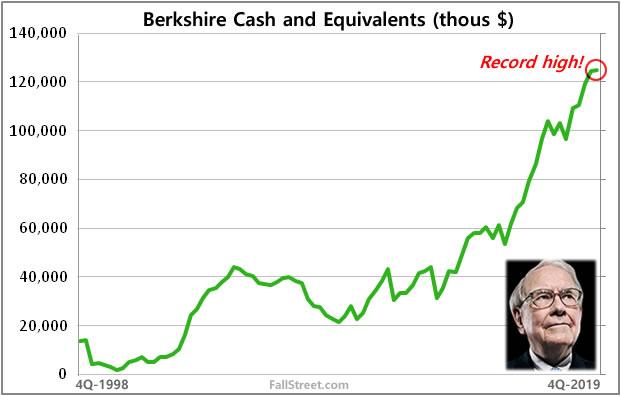

As the markets stabilized in 2009 Buffett – knowing that the time to be greedy had passed – started raising cash. And since Berkshire’s cash position bottomed at $21 billion in 2Q09 it has steadily increased to more than $120 billion!

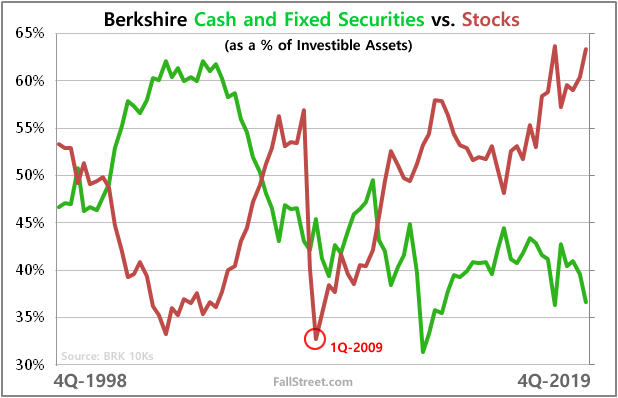

While many have pointed to Berkshire’s cash pile to speculate that Buffett has either lost his touch or is itching to make some massive deals, the reality is that leading into 2020 Berkshire’s relative exposure to stocks was very high. In other words, when compared to stocks the cash and fixed income totals are not that outrageous (and even if you lop 20% off of BKR’s stock holdings, equities exposure would still be high based upon history).

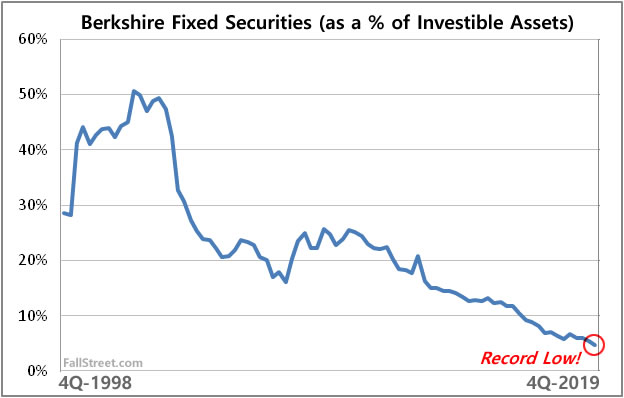

Which brings us to one of the reasons why Buffett seems to be hoarding cash and/or reluctant to increase Berkshire’s exposure to equities – BONDS! In recent years Buffett has repeatedly described low yields on government bonds as “mind-boggling”, noting that stocks will almost certainly outperform bonds over the long-term.

The Wisdom of Buffett

Remembering that Berkshire has been growing its cash position for more than a decade, now read another snippet from Buffett’s 2008 commentary:

“Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value.” Buffett – October 2008

Yes, Buffett is fully aware that cash is a terrible long-term asset and Berkshire’s $120+ billion war chest is wildly high in both absolute and common sense terms (even though cash is not abnormally high when contrasted against $250 billion in equity holdings). Nevertheless, there are two sage reasons why the Oracle of Omaha is so enamored with cash today:

1) Buffett loves cash because there has not been another opportunity to “buy when others are fearful” since early 2009. Leading into 2020 stocks were in their longest bull market ever!

2) Buffett loves cash because he absolutely despises bonds. Leading into 2020 bonds were in a nearly 40-year boom!

Against the untenable backdrop of rising stock and bond prices Buffett doesn’t mind that Berkshire’s high cash position dilutes short-term performance. And unless you believe that stocks have reached some type of permanently rigged plateau, Berkshire’s cash position is an indication of strength, not weakness.

Incidentally, even if money managers on Wall Street believed that holding more cash would be wise, most would be unable to follow Buffett’s lead. For a brief explanation of why, here is Buffett, from 1984:

“Most managers have very little incentive to make the intelligent-but-with-some-chance-of-looking-like-an-idiot decision. Their personal gain/loss ratio is all too obvious: if an unconventional decision works out well, they get a pat on the back and, if it works out poorly, they get a pink slip.” Buffett – 1984

In short, raising cash as stock prices boom and/or valuations become stretched is a very intelligent thing to do. Berkshire was/is prepared for when the next bear market mauling transpires (This assumes, of course, that Buffett didn’t quietly put a major dent in cash during the 1Q-2020 market meltdown).

Related:

September 20, 2017 – Bullish Buffett’ Pulpit

February 16, 2011 – Sell American. Buffett Is.

August 30, 2007 – Where is the Fear Mr. Buffett?