|

June 11, 2008

The Fed Would Love It If It’s Bluff The Dollar Higher Plan Stays Together

On Tuesday June 3, 2008 Fed Chairman, Ben Bernanke, broke with tradition and openly acknowledged that the Fed was watching the U.S. dollar.

“We are attentive to the implications of changes in the value of the dollar for inflation and inflation expectations and will continue to formulate policy to guard against risks to both parts of our dual mandate, including the risk of an erosion in longer-term inflation expectations.” June 3, 2008 ~ Bernanke

While Bernanke’s comments temporarily supported the dollar versus many of the majors, later in the week European Central Bank President, Jean-Claude Trichet, shocked investors when he said that a rate hike was ‘possible’ in July. With Trichet’s threat of action easily trumping Bernanke’s words the dollar quickly lost 2.6% versus the Euro (or more than 4 cents post-Trichet) to end last week.

With the dollar mini-crash to end last week playing a role in crude’s historic 8% spike higher on Friday, over the weekend a series of jittery phone calls between policy makers were undoubtedly made. The plan of attack from these sessions was elementary: talk the dollar higher. And talk is exactly what policy makers have done to begin this week; President Bush openly said “We want the dollar to strengthen”, Treasury Secretary Paulson stated that he would “never take [currency] intervention off the table”, and Bernanke added that the Fed “will strongly resist an erosion of longer-term inflation expectations.” For good measure, other numerous second tier U.S. policy makers have chimed in about the threat of inflation, and Trichet himself doved-down his previous comments on Monday:

“I will repeat exactly what was said. I did not exclude that we could increase by a small amount present interest rates. I said it was not certain, but it was possible…I never said there was a group in favor of a series of interest rate rises".

What the above events and subsequent market volatility over the last 7-days have helped highlight is that U.S. policy makers are hoping for the best while their counterparts threaten or in some cases take real action. To highlight some recent examples, along with Europe’s unwavering approach to hitting inflation with tight monetary policy, China raised banks' reserve requirement ratios for the fifth time this year yesterday and Canada opted not to cut interest rates earlier this week even though Canadian GDP contracted in 1Q08. Ominously, these and numerous other hawkish developments suggest that credit crisis fears have started playing second fiddle to inflation fears in the minds of central bankers.

But Will The Fed Really Need To Fight Inflation?

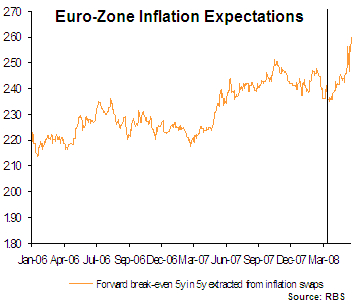

Inflation expectations are high and rising and growth expectations are low and falling. Bernanke and company hope that the latter will help placate the former, and that they will not be called on their bluff to raise interest rates. The reason why the Fed is ‘bluffing’ is because after expending a great deal of energy battling the subprime/credit crisis quickly switching gears now (or before the aforementioned crisis’ are in the history books) would be akin to admitting that previous policy actions failed miserably.

In other words, attempting to limit money creation via interest rate hikes – the central bank weapon of choice - is the exact opposite path Bernanke has been on since the subprime monster reared its head in August 2007. If the Fed is forced to try and decapitate inflation expectations they will be endlessly criticized, the financial markets could enter a period of heightened uncertainty, and the real estate/credit slump could intensify – all this before the stimulus efforts over the last 10-months bare any fruit! Thus, the Fed’s plan of attack seems to be to try and talk the dollar higher, try to scare commodity speculators, and perhaps also try to get the bond market to do some of its [slow down] bidding.

Incidentally, anyone that thinks the Fed can effortlessly beat inflation and support the dollar with rate hikes needs to read the history of Volcker – not the man that is praised today for beating inflation in the 1980s, but the Fed Chairman that was hated and cursed by nearly everyone and who caused serious financial agony in the early 1980s before he beat inflation. How can Bernanke do an impression of Volcker if his recent easy money policies helped cause today’s inflationary threat? If unprecedented Fed protests greeted Volcker just imagine the wrath that would cast upon Bernanke if he surprises with a rate hiking campaign anytime soon...

In closing, is the Fed really about to take a stand against inflation? If ‘inflation expectations’ are really what Bernanke is concerned about the answer could be yes, although Bernanke’s unwillingness to acknowledge the potentially painful repercussions of a central bank affront on inflation makes you wonder if the helicopter is really about to come in for an abrupt landing. To reiterate, inflation expectations are high and rising and growth expectations are low and falling. Bernanke hopes that these two trends, along with anti-inflation rhetoric, will be enough.

|

|

|