August 19, 2010

Krugmanism Explained

By Brady Willett

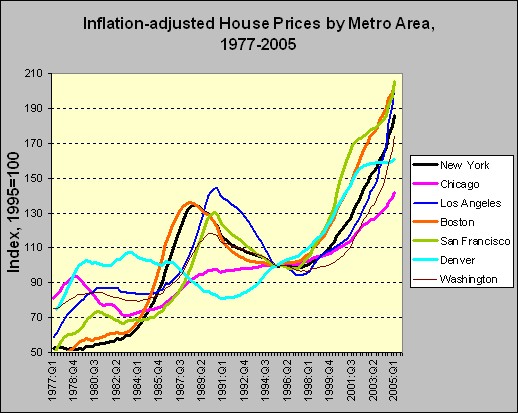

At 9:15 AM yesterday Paul Krugman posted a chart of U.S. home prices from 1977-2005. Using this chart he concluded, ”Sorry: the evidence just screamed bubble. No excuses for those who didn’t want to hear it.”

|

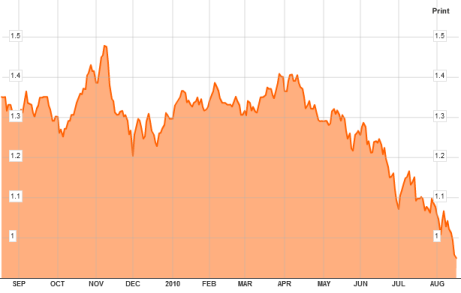

A few hours later Krugman posted a chart of 10-year Japanese interest rates, which have fallen below 1% and which many people believe highlight a disaster waiting to happen. However, rather than comment that these ultra-low interest rates are indicative of bubble forces in the marketplace, Krugman contends the exact opposite.

“We’re facing a slow-motion catastrophe because policy makers were afraid of the wrong things.” [or because Japanese and other policy makers didn’t borrow enough!]

|

With the intention of embellished amusement, if you flip the supposedly non-bubble Japanese interest rate chart and overlay it on the U.S. housing bubble chart, you come up with the following:

|

While it is interesting that the charts have similar contours, remember that the Japanese interest chart was only for the last year! In other words, in Krugman-land while a long-term spike higher in U.S. home prices is clearly evidence of a bubble, an even more dramatic short-term fall in Japanese interest rates is merely a signal that the Japanese government is not borrowing enough. At a time when many are warning that Japan is headed towards a fiscal catastrophe because of excessive borrowing, you have to give Krugman credit for having the bravado to take this tact.

Bubbles Do Not Exist Until Krugman Hears The Pop?

Echoing his like-minded friend Brad DeLong, Krugman appears to be using bubble prices as a justification of bubble prices. However, analogous to the U.S. housing bubble staying buoyant for an extended period of time, so long as Japanese interest rates remain low it is difficult to definitely demonstrate that a bubble in Japanese really exists.

But what if Japan defaults – wouldn’t this be proof of a mania in the Japanese debt markets? Absolutely not! A default would simply mean that Japan should have borrowed more money before it was forced to default from borrowing too little money.

Thanks Krugman for your enlightened display of what we commoners would simply gulp down as absurd. We are beginning to understand…

BWillett@fallstreet.com