June 8, 2003

Big Talkers, Thinkers, and Small Investors

Given that calls for a new bull market abound, it is extremely tempting to take a moment and expand upon the bear’s case; or highlight all the reasons why the current stock market rally will not be sustained. However, rather than regurgitate all that was covered during the mania, a quick summary of the bearish point of view will suffice:

Bear Case: If the US economy/corporate earnings do not rebound strongly in the second half of 2003 it will be financial Armageddon.

Suffice it to say, due to the recent rally I have turned my tent into a log cabin within camp bear -- I firmly believe that those who choose to use the term ‘bear market’ in a past tense are doing so at their peril. Nevertheless, it should be pointed out that I also felt the same way in late 1998, or before one of the biggest stock market booms in history turned into the biggest boom. As expected, the 1990s boom turned to bust, yet the wait was long, and shorting stocks – something speculators or reverse Buffett type fundamentalists do - meant financial suicide. There is no telling for certain how long the current ‘boom’ will last.

|

|

|

Big Talkers – Fleck versus Glassman

In a recent testimony James Glassman – co-author of Dow 36,000 - confirmed that he is either a foot soldier for non option expensing tech corporations or completely out to lunch:

“Under the current regime, investors who require information on stock options can get it – and get it in spades.” (referring to the thoroughness of stock option footnotes)

“…to force all companies to take an immediate hit against earnings when they grant options would be to misrepresent the firm’s potential for generating future cash flow.”

Think about: Glassman argues that investor’s understand how options are expensed in footnotes and that this disclosure is all that is required. Yet his main argument against forcing companies to expense options is that these same investors will be unable to figure out why earnings are taking a ‘hit’ when stock options move from the footnotes to the income statement. Does Glassman really believe that investors only read and completely understand footnotes when bad stuff is hidden within them? Can Glassman please explain to anyone with common sense why investors fully understand ‘earnings would be 12% lower if options were expensed’ but have no idea how to comprehend ‘earnings would have been higher by 12% if options were not expensed’???

In Fleck’s most recent Contrarian Chronicles he describes the markets as he sees them:

“All of what's been happening was very predictable…I wanted to leave a paper trail so that when we got to this point, I could try to put the situation into perspective for everyone. The purpose of this review is to offer up food for thought as an antidote to the arm waving that continues to hold sway…”

In fact, Fleck is the one doing most of the arm waving. In a verbose attempt at conveying his understanding of the markets the usually insightful Fleck highlights his convoluted ‘paper trail’ as if this trail of paper is more noteworthy than a trail of profits/losses.

Have Glassman and Fleck Switched Places?

In Glassman’s latest – if you can stomach reading him – he actually makes some constructive points. To be sure, and assuming the two companies he mentions have concrete businesses, PAYX and SDS are not likely to crater during even the toughest business environments. This is not an endorsement of Glassman’s selections – it is difficult to determine which companies have the leadership role (ADP) in the group, and while sturdy each company is economically sensitive. However, the stocks Glassman highlighted do consistently generate free cash flow, and his comments are more noteworthy than his usual (i.e. ‘Dow 36,000 was only figure of speech and I am not nuts’).

Glassman spent much of the last three years defending his position and concocting inane reasons to still be bullish. Will Fleck spend the rest of the summer defending his ‘markets could go higher but be ready for Armageddon’ position? As silly as this question may seem, is Fleck all about speculation whereas Glassman is about- albeit usually crackpot - fundamentals?

Big Thinkers That Miss Big Time

Following any major move in the markets/economy you can easily find a book/paper/or commentary from someone that seems to have predicted the move with stunning accuracy. However, finding such a source beforehand is more challenging.

After a string of correct forecasts, Ravi Batra, an economics professor at Southern Methodist University in Dallas, struck out with his well written book ‘The Great Depression of 1990’ (1985):

”…the depression of 1990 is now all but inevitable. The supporting evidence for this conclusion comes from a wide spectrum of sources, including the long-run patterns of money growth, inflation, regulation, and depressions, and above all, the law of social cycles (pg. 170).”

Not one to rest on failure – despite a mild recession 1990 turned out to be the launch pad for the greatest economic expansion on record - Ravi came back in 1998 with ‘Stock Market Crashes of 1998 and 1999’, and in September 1999 with ‘The Crash of the Millennium: Surviving the Coming Inflationary Depression.’ Assuming he lives long enough, one of these decades Ravi is sure to be right about a depression. However, does he only get half points if it is a deflationary instead of an inflationary depression?

Next, there is the book ‘THE GREAT BU$T AHEAD (2002)’, wherein Daniel Arnold portends to explain why ‘The Greatest Depression in American & UK History is Just Several Short Years Away’:

“80 plus years of tight correlation from 1920 to 2002 of the number of 45 to 54 year old Americans with the ups and downs (booms an busts) of the economy cannot possibly be a mere coincidence. That these high spending Americans control the long-term peaks and valleys of the economy is clearly now utterly beyond dispute. It is really as straight forward as this. The economics text books need to be rewritten.”

Mr. Arnold forecasts that $18 Trillion will be lost in stock market wealth between 2013 to 2025. However, before this happens he sees the Dow going to 13,000-14,000 in 2003/4 first. Provocative conclusions for a 50 page massive font book.

Small Investors Left to Fend for Themselves

The current debate concerning deflation is one of the most stunning combinations of big time talking and big time thinking ever. In order to participate in this debate you need to forget about specific investment opportunities, and think big picture. Here are two small points of view to think about:

1) If the US consumer does what the Japanese consumer previously did (i.e. they begin stuffing 20+% of their income in their mattresses) deflation is not only the likely outcome, but probably the only outcome regardless of what the Fed tries to pull.

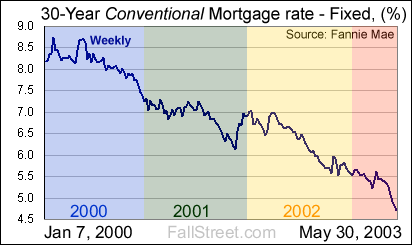

2) If the Fed is successful at combating deflation interest rates will eventually rise. No one – either the talkers or thinkers – has the faintest idea of what will happen to the US economy when, and if, interest rates begin to rise.

Soft demand statistics aside, there is scant evidence of deflation becoming increasingly problematic. To be sure, with the stock markets soaring, bonds rallying, and the dollar weakening - something most thinkers and anyone with common sense did not believe was possible three months ago – the ‘thinking’ is that interest rates will remain near record lows until economic activity picks up, stocks will remain rich so long as interest rates remain low (?), and the weakening dollar means that some welcomed inflationary pressure is being built into the system.

How do you make sense of this action (not to mention a sturdy gold price which is supposedly pricing in deflationary troubles or a jump in interest rates)? Well, the talkers say Greenspan is either a genius or is crazy for helping to orchestrate the current euphoria filled rally in stocks and bonds, and the thinkers debate what effect, if any, tax cuts and a weakening dollar will have on an anemic US economy. The small investor - looking for a return on investment while trying to avoid getting into an economics debate - is overwhelmed…

To reiterate, the BIG question is do stocks cheer a rise in interest rates because deflationary pressures have been beaten or do they crash because housing market activity will grind to halt? I don’t know for sure…moreover, who really knows that interest rates are going to head higher anytime soon?

Perhaps all that is known is that the recent action in the markets makes the hunt for undervalued investments extremely difficult -- perhaps impossible from an asset class perspective until the stock/bonds/dollar/gold conundrum begins to make a little more sense. To reiterate – interest rates, interest rates, interest rates…

|

“If past history was all there was to the game, the richest people would be librarians” Buffett.

|

All data and information within these pages is thought to be taken from reliable sources but there is no guarantee as such. All opinions expressed on this site are opinions and should not be regarded as investment advice.

Copyright © 2000-2003. FallStreet.com